If I Am Totally Disabled Can I Continue to Get Ltd After 24 Months Michigan

There are several things that impact how long you can stay on claim and receive long-term disability benefits. This article will discuss a few of these things, including definitions of disability, benefit limitations, and the maximum benefit period, but it is important to read your long-term disability policy in order to understand your specific coverage.

Definition of Disability

Generally, long-term disability (LTD) benefits are payable, meaning you can stay on Long-Term Disability as long as you remain disabled under the terms of your policy. Your long-term disability policy provides the definition of disability that you need to meet. The requirements of the definition of disability can vary from policy to policy and determining if you meet that definition can have many factors, so it is important to read your entire policy closely to determine how long you can stay on long-term disability.

When you initially stop working, most LTD policies will pay benefits if you are disabled from your own occupation. In order to be disabled from your own occupation, you typically must be unable to perform one or more of the material duties of the job you were doing at the time you became disabled. Generally, insurance companies will evaluate your ability to do your own occupation based on how that occupation is performed in the national economy and not how it is performed at your specific employer.

However, frequently, the definition of disability changes after benefits have been payable for 24—48 months. At that time, the definition may change to an any occupation definition, which means you must be unable to perform one or more of the material duties of any job. Sometimes the any occupation definition of disability takes into account your age, training, experience, or pre-disability earnings, but not always. These definitions are often broad and vague, providing insurance companies the opportunity to suggest you could perform an occupation that you cannot.

Insurance companies frequently terminate benefits when the definition of disability changes from own occupation to any occupation. Insurance companies may terminate your benefits on grounds that you are able to do another occupation, even if you are not qualified for it or it would be an unreasonable expectation given your health, age, and experience. Responding to these termination letters can be challenging. You should contact an attorney if your benefits are terminated and do not believe you can work in any occupation.

Can I Work While on Long-Term Disability?

Even if you regain functional capacity to return to work to some degree, you may still qualify for reduced LTD benefits. This is typically called partial disability. Like the own occupation and any occupation definitions of disability, the exact definition of partial disability can vary from policy to policy. Some policies require you to remain disabled from your own occupation but allow you to work in another occupation, while others will allow you to work in your own occupation as long as you have had a loss of income as a result of your disability.

Can My Long-Term Disability Benefits Be Limited Due to My Medical Condition?

Even if you continue to meet the definition of disability, LTD policies often contain limitations that restrict the amount of time for which benefits are payable. Frequently, these limitations are based on the type of medical condition that is disabling you. For example, many LTD policies limit benefits for mental health conditions to 12—24 months. Your policy may also have a non-verifiable symptom limitation. This typically means that after a certain number of months, you will no longer qualify for benefits if you are disabled due to subjectively reported conditions, like ringing in the ear or fatigue. These are just some examples. You should read your long-term disability policy carefully to understand all the limitations it contains. These limitations can be frustrating and appear unfair. You should contact an attorney if your claim is being subjected to a limitation that you feel is not appropriate.

What is a Maximum Benefit Period for Long-Term Disability (LTD) Benefits?

The length of time you can receive long-term disability (LTD) benefits depends on the terms of your policy. Many LTD policies contain aMaximum Benefit Period, which defines how long long-term disability benefits last. Because theMaximum Benefit Periodcan vary from policy to policy, it is important to read your policy to determine howyour policy defines it and thus how longyour benefits will last. You should also keep in mind that some policies may use different language or terminology to describe theMaximum Benefit Period(e.g. Maximum Duration, Maximum Indemnity Period, etc.).

Common Maximum Benefit Periods for LTD Policies

AlthoughMaximum Benefit Periodscan vary, there are some common ones. Many policies provide long-term disability benefits until age 65. Other policies offer benefits until your Social Security Normal Retirement Age (SSNRA). Your SSNRA depends on the year you were born. Alternatively, some policies will specify the number of months for which benefits are payable according to your age at the time you become disabled. Finally, although it is rare, some policies even provide lifetime benefits.

How Do I Receive Benefits for the Maximum Benefit Period?

Typically, in order to receive benefits for theMaximum Benefit Period, you must remain disabled under the terms of your policy. There are many factors in determining if you are disabled and entitled to benefits under the terms of your policy. A good place to start is to locate theDefinition of Disability in your policy. As long as you continue to meet theDefinition of Disability under the terms of your policy, your benefits should continue.

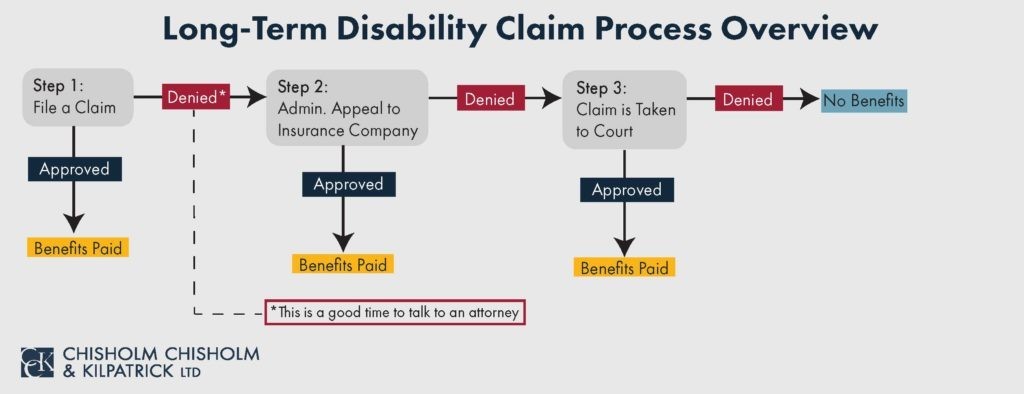

Insurance companies will periodically conduct reviews of your claim to see if you still qualify for benefits. Insurance companies sometimes operate in their own financial interest. You should contact an attorney if you think the insurance company may terminate you or if you have already been terminated but feel you are still disabled. The appeal process can be daunting. At Chisholm Chisholm & Kilpatrick LTD, our team of experienced attorneys and professionals can help you stay on claim or get back on claim and stay there. Contact us now at 401-237-6412 for a FREE consultation to see if we can assist you with your long-term disability claim.

Source: https://cck-law.com/blog/how-long-can-you-stay-on-long-term-disability-ltd/

0 Response to "If I Am Totally Disabled Can I Continue to Get Ltd After 24 Months Michigan"

Post a Comment